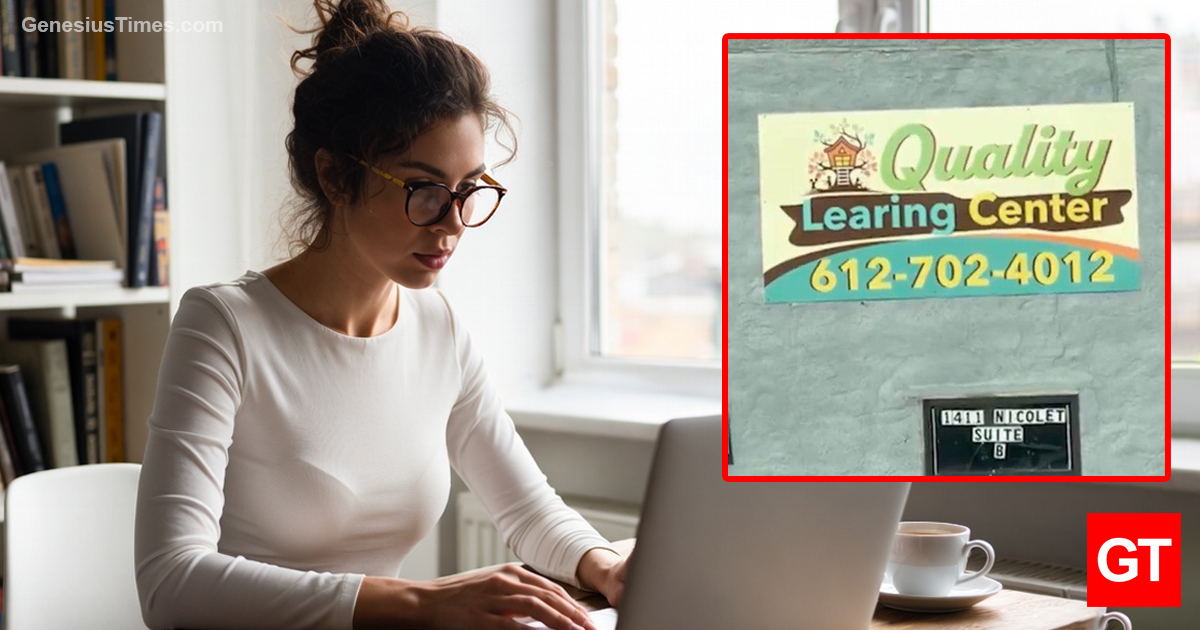

In these trying economic times, savvy taxpayers are always on the lookout for clever ways to reduce their burden to Uncle Sam. Enter one of the most underrated life hacks circulating in certain enlightened financial circles: turning your involuntary donation to the Quality Learing Center into a legitimate charitable write-off.

Yes, you read that right. That chunk of your hard-earned income quietly siphoned off through state and federal child care assistance programs fraud—without your explicit consent, and often without any visible children learing anything (quality or otherwise)—can potentially qualify as a deductible contribution. Here’s how to make it work, dryly and without fanfare.

Step 1: Recognize the Transaction for What It Is

Your “donation” arrives via payroll withholding, sales taxes funneled into bloated welfare budgets, or simply existing as a productive citizen in a high-redistribution jurisdiction. In fiscal 2025 alone, the Quality Learing Center masterfully accepted approximately $1.9 million in such philanthropic largesse, despite operating hours that appeared curiously child-free and a signage philosophy that boldly embraced creative spelling (“Learing” — a forward-thinking statement on educational priorities). This wasn’t theft; it was crowd-sourced philanthropy. You just didn’t get a thank-you card. (And nationally, similar programs have funneled billions in involuntary contributions into the ecosystem—your share is in there somewhere.)

If you want to get really charitable, you could argue that you involuntarily donated to all of the upwards of $521 billion in fraud estimated to occur in the US every year, but that may raise an eyebrow or two at the IRS, so savvy taxpayers may want to claim just your share of that ($3473).

Step 2: Confirm Qualified Status

Under IRS Publication 526 (Charitable Contributions, because nothing says “timeless advice” like rules that lag reality), donations to qualified 501(c)(3) organizations—or entities receiving substantial government support for educational purposes—are generally deductible if you itemize. The Quality Learing Center, licensed to serve up to 99 young minds (whether actually living and real or not), provided a vital public service: demonstrating how efficiently taxpayer funds can support community entrepreneurship. Bonus points if the center operated under any nonprofit umbrella or simply existed as a pass-through for noble causes. Check the IRS Tax Exempt Organization Search tool—or just assume the government wouldn’t fund it if it weren’t qualified. (Bonus: the sign was eventually fixed, proving adaptability in the face of viral scrutiny.)

Step 3: Document Like a Pro

The IRS is famously picky about substantiation. Gather your evidence:

- Your W-2 or pay stubs showing federal/state income tax withheld (your direct contribution).

- State budget reports or news articles confirming the $1.9M+ flow to the center in fiscal 2025 (public records are your receipt; scale up pro-rata from broader program totals approaching billions).

- Screenshots of the viral video exposing the empty facility and iconic “Learing” signage (visual proof of the educational mission’s austere minimalism and orthographic innovation).

- A personal affidavit stating: “I involuntarily supported quality learing initiatives via compulsory taxation, with no expectation of direct benefit or toddlers on site.”

For non-cash contributions (your labor value lost to taxation), estimate conservatively. The IRS caps most deductions at 60% of AGI anyway—plenty of room for your slice of that multimillion-dollar (or billion-dollar ecosystem) masterpiece.

Step 4: File with Confidence

On Schedule A (Itemized Deductions), list it under “Gifts to Charity.” Description: “Involuntary contribution to Quality Learing Center educational services via public child care assistance allocation.” Amount: Calculate your pro-rata share based on total funds disbursed divided by U.S. taxpayers (or just round up for simplicity; the spirit is what counts). Attach Form 8283 if over $500, though in this case the “non-cash” nature (intangible societal benefit) may qualify for simplified reporting.

Pro Tips from the Pros

- Audit risk? Minimal. The IRS rarely questions deductions that align with government-approved spending priorities—even when centers close shortly after exposure.

- Bonus refund potential — If enough citizens claim this, it could create a feedback loop where the write-off stimulates more “donations.” Win-win.

- Moral satisfaction — You’re not evading taxes; you’re reclassifying an expense the government already spent on your behalf.

In conclusion, forget 401(k) matches or HSA contributions. The real alpha move in 2026 personal finance is claiming your slice of the Quality Learing Center’s legacy as your own charitable legacy. Because nothing says “deductible goodwill” like funding excellence that spells its own name wrong, may or may not have contained children, and ultimately shuttered amid national attention.

Your accountant may call it aggressive. We call it savvy patriotism.

![]()