doyouremember.com

Robert Irwin Gets Support From His Niece At ‘Dancing With The Stars’ Premiere

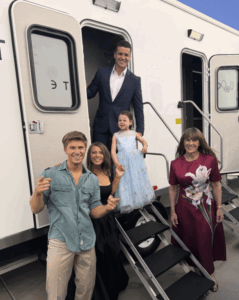

Robert Irwin made his debut on Dancing with the Stars with his entire family cheering him on, but one supporter stole the spotlight. According to People, his niece Grace, the 4-year-old daughter of Bindi Irwin, arrived in a sparkling blue ballgown to celebrate her uncle’s big moment. The sweet family outing highlighted just how close the Irwins remain, years after first capturing the world’s heart alongside Steve Irwin.

In the adorable photo shared on both Bindi and Robert’s Instagram accounts, Grace stood proudly beside her mom, wearing a gown adorned with silver stars. Her dad, Chandler Powell, beamed behind her, while her grandmother, Terri Irwin, smiled in a burgundy floral dress. The picture perfectly captured the Irwins’ tradition of turning milestones into family celebrations, and this time, it was Robert Irwin’s turn to shine.

Robert Irwin’s Dancing With The Stars Debut

robertirwinphotography/Instagram

For Robert Irwin, stepping onto the Dancing with the Stars stage marked the fulfillment of a long-held dream. He revealed that he was inspired by his sister Bindi’s win on the show ten years ago. “I remember coming to every live taping to watch her and thinking, ‘One day I have to do this,’” he said. Now, with partner Witney Carson, he is ready to embrace the challenge, bringing his trademark enthusiasm and passion to the competition.

View this post on Instagram

A post shared by Bindi Irwin (@bindisueirwin)

In his caption ahead of the premiere, Robert shared his excitement, writing, “The fam has arrived for the live show!” His Instagram post, featuring smiles all around, showed just how much this moment means to the entire family. Even before the first dance, the Irwins demonstrated that Robert’s time on the show will be a shared journey, much like every milestone they’ve experienced together.

Carrying On A Family Legacy

Robert Irwin/Instagram

The Irwins’ support for Robert underscores their enduring family bond and commitment to honoring the spirit of Steve Irwin. Just as Bindi’s journey on Dancing with the Stars became a touching chapter in their story, Robert’s debut carries the same sense of pride and continuity. For Robert Irwin, competing is about more than winning a trophy—it’s about celebrating the lessons of resilience, joy, and togetherness that his family has always stood for.

Robert Irwin, Bindi Irwin, and her mother/Instagram

Grace’s sweet appearance in her starry gown added an extra touch of magic to the night. While Robert Irwin takes on the challenge of the dance floor, the presence of his loved ones, especially his niece, is sure to keep him grounded and inspired. As his journey unfolds, fans can look forward to watching him carry the Irwin legacy into yet another spotlight.

View this post on Instagram

A post shared by Robert Irwin (@robertirwinphotography)

Next up: Dolly Parton Misses Dollywood Event Due To Health Issues

The post Robert Irwin Gets Support From His Niece At ‘Dancing With The Stars’ Premiere appeared first on DoYouRemember? - The Home of Nostalgia. Author, Ruth A